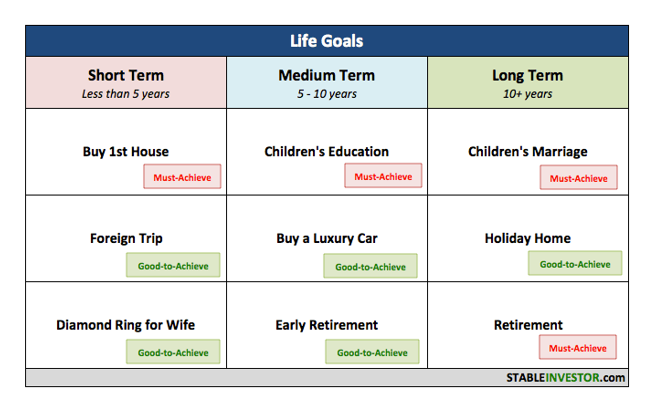

This post shows how goalbased investing can help you afford your dream home downpayment and EMI Buying a home is one of the most critical decisions in your life Apart from the psychological aspects of homeownership (safety, security andImportance of identification of goalsShort term goals and long term goal identificationbased on short term and long term how much we have save explainedGet it now It is also available in Kindle format

Goals Based Investing An Approach That Puts Investors First

Goal based investing pdf

Goal based investing pdf- You Can Be Rich Too with GoalBased Investing Published by CNBC TV18, this book is meant to help you ask the right questions, seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle!Start saving early Learn how to save money first;

Goal Based Investing Plan Ahead Simplifying Your Financial Life

GoalBased Investing Before you start investing money into the market, ask yourself one question What exactly are you saving and investing for?Then learn how to invest We'll use riskfree strategies to accumulate savings in this episode, and then iDon't invest in a portfolio, invest in reaching each individual financial goal that you have The portfolio is just the vehicle you need to achieve each goal, so each portfolio should represent its own goal

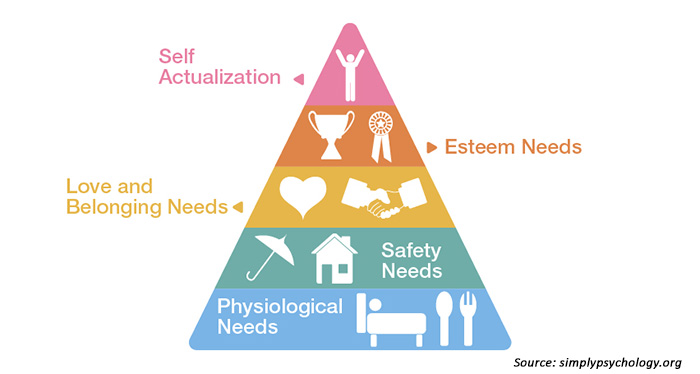

Last Updated on Here is a stepbystep to guide, plus calculator, to begin and track longterm goal based investing Most goal planning calculators tell you how much you should invest This sheets asks you, how much you can invest and goes about calculating the portfolio return With that you can calculate the asset allocation required (equity to fixed income Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets andGoalsbased investing empowers intermediaries, institutions and individuals alike to focus on what really matters achieving goals And when you marry those goals with our global economic perspective, it's a powerful framework that Improves on traditional portfolio construction, as it places a larger emphasis on alignment with investor goals

Goal based investing is an investment framework which helps you align your existing as well as new investments to your financial or life goals It helps you diversify your investments as it helps you understand the right type of investment for each goal It ensures that you are aligning your investments as per your priorityGoalBased Investing Research is conducted by experienced wealth managers and investment firm's clients It involves checking the progress of the GoalBased Investing strategy and how much it has supported in achieving the specific life goals Goalbased investing is better because it is a SMART (specific, measurable, attainable, relevant Goal based investing is based on the premise that financial planning is more effective when you work towards achieving a goal rather than chasing returns A goal based investment strategy first creates a personalised financial goal according to the investor's age, income, expenses, savings and risk appetite

Where There S A Goal There S A Way Goal Based Investing

The Value Of Setting Investment Goals P2p News

Lasso puts investors and advisors on the same side We've made it easy to build a plan for your money No financial knowledge needed And, we're creating a community of investors and advisors that is based on sharing information about people's goals When the conversation is focused on what really matters your goals we think everyone wins Goalbased investing doubles down on your commitment to your life goals by aligning your finances with the rest of your life decisions Sounds so obvious once you think of it, and that's why it works By thinking about your investments from an overall life standpoint, Goal based financial planning is simply a structured approach to goal based investing that can ensure a much higher chance of success in meeting your financial goals It is always recommended to engage a financial planner or advisor, if you think you need help The most important success factor in financial planning is your commitment towards

A Framework For Goals Based Investing Boston Private

My Goals Are Beyond Your Understanding

Goal Based Investing Italia 4 likes 9 talking about this Immagina di cominciare a pianificare gli investimenti di un cliente, partendo invece che dalla fine (le performance), dall'inizio (i Goalbased investing rationale, benefits and guidelines Goalbased investing the planning process, in practice Why we need to invest, and savings aren´t enough Search this website Newsletter Subscribe toGoalBased Investing Goldman Sachs Personal Financial Management Goldman Sachs PFM Connect with a financial advisor For Personal Finances For Financial Advisors Client Login Our Approach

How To Optimize A Goal Based Portfolio Franklin J Parker Cfa

Why Practicing Goal Based Investing Is Essential For Small Investors

Quick Guide Goal based Investing and Asset Allocation All of us would love to achieve our dreams, without having to worry about how to finance them But in reality, we often end up compromising on our dreams To achieve our dreams, we need to plan and make the right choices at the right time Planning for our dreams involves saving and Goal based investing allows a mutual fund investor to set risk parameters for goals depending on varying importance, measuring success or failure against each real world goal rather than looking at the stock marketGoalbased investing is a process that makes your investments after setting up goals on what you want to achieve in the future Mapping out all your needs gives you a clearer picture and the time for which you need to stay invested to achieve each goal Even the type of risk you should take will be defined by your goals

1

Where There S A Goal There S A Way Goal Based Investing

Goalbased investing allows you to better understand why you are saving money, which can also be quite motivating If you're saving to buy a home, for example, knowing that is your goal allows you to visualize what your investment efforts are working towardLa casa del Goal Based Investing in Italia Luciano Scirè Lavoro da anni nel mondo finanziario Ora però è giunto il momento di dedicarmi alla costruzione della casa italiana del Goal Based Investing e alla diffusione di questa culturaApplying GoalBased Investing Principles to the Retirement Problem — May 18 Abstract In most developed countries, pension systems are being threatened by rising demographic imbalances as well as lower growth in productivity With the need to supplement public and private retirement benefits via voluntary contributions,

Going Deeper With Goals Based Investing Amg Funds

Goal Based Investing Investing Mutuals Funds Market Risk

Goalbased investing helps you answer important questions like how much to invest, where to invest, and when to start investing Moreover, it also gives you a purpose to stay invested And helps you fight your biggest enemy – Your impulsiveness Goal based investing differs from traditional investing methodologies, where financial performance is defined as a return against an investment benchmark Also, instead of pooling all assets into a single portfolio, separate goalspecific investment portfolios can be created for each goal Why Goal Based Investing and Saving Work When it comes to saving money, goal based financial planning is a secret weapon By putting the focus on the specific things you want to achieve, you forge a connection with the acts of both saving and investing You become emotionally invested in seeing your goals through to the end

Goal Based Investing How Does It Work Everyfin Newsletter

Investment Management Integrated Wealth Management Financial Planner Investment Management Seattle

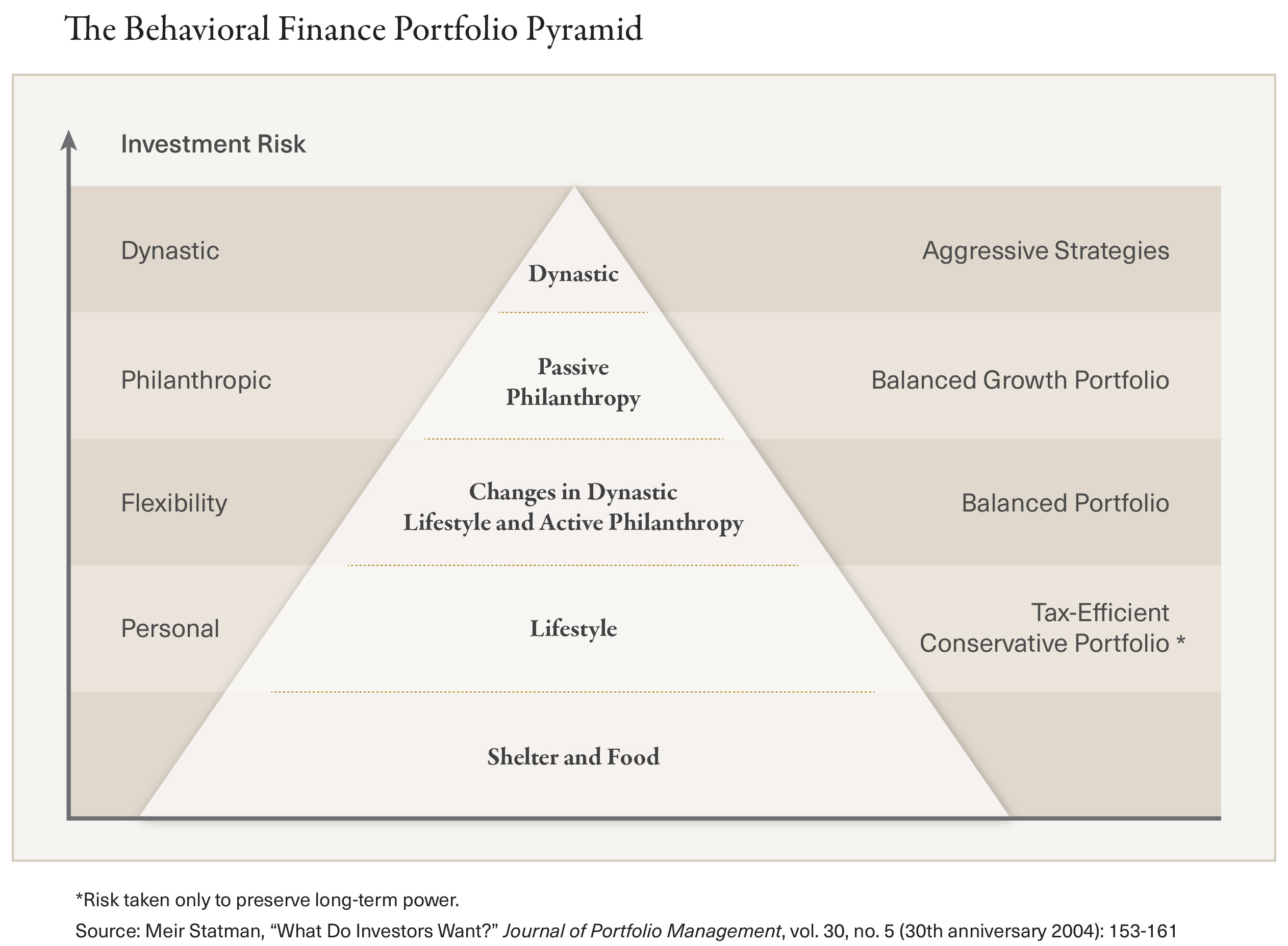

Goalbased investing (GBI) implements dedicated investment solutions to generate the highest possible probability of achieving investors' goals, with a reasonably low expected shortfall in case of adverse market conditions To practice goal based investing, it is equally essential to keep reviewing ones financial goals once every year Read more about how tough financial goals need higher investment risks Fixing financial goals for self, and making investments accordingly, will always keep you in control of your actionsTo paraphrase Richard Thaler, all finance is behavioral In the same spirit, all investment management should be goalsbased After all, both institutional and private investors hold assets to meet their liabilities and achieve their financial objectives

Goal Based Investment Fincareplan

Goal Based Investing Designs Themes Templates And Downloadable Graphic Elements On Dribbble

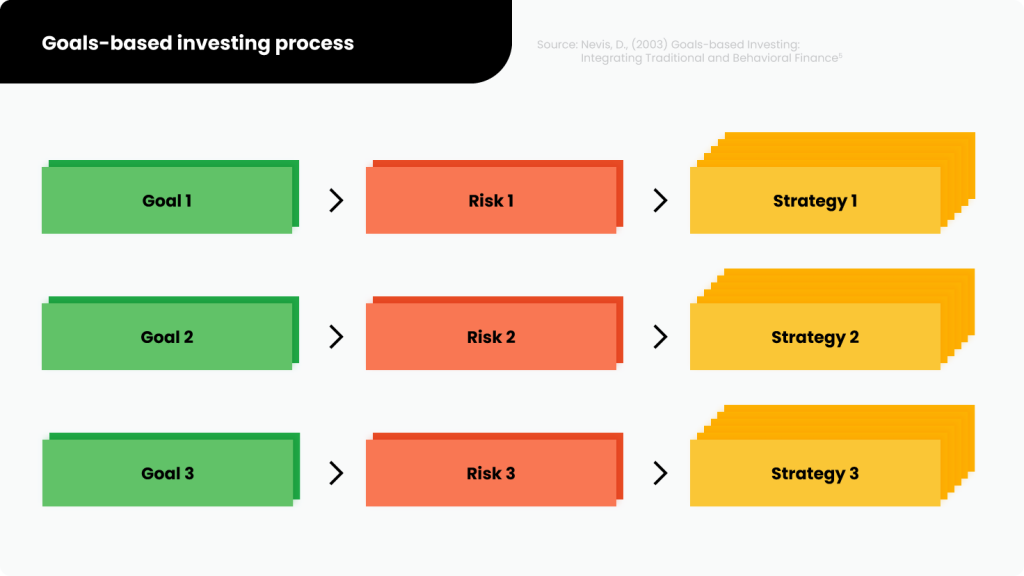

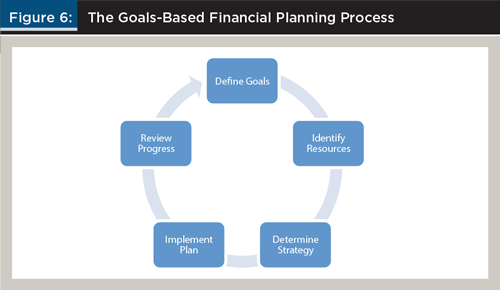

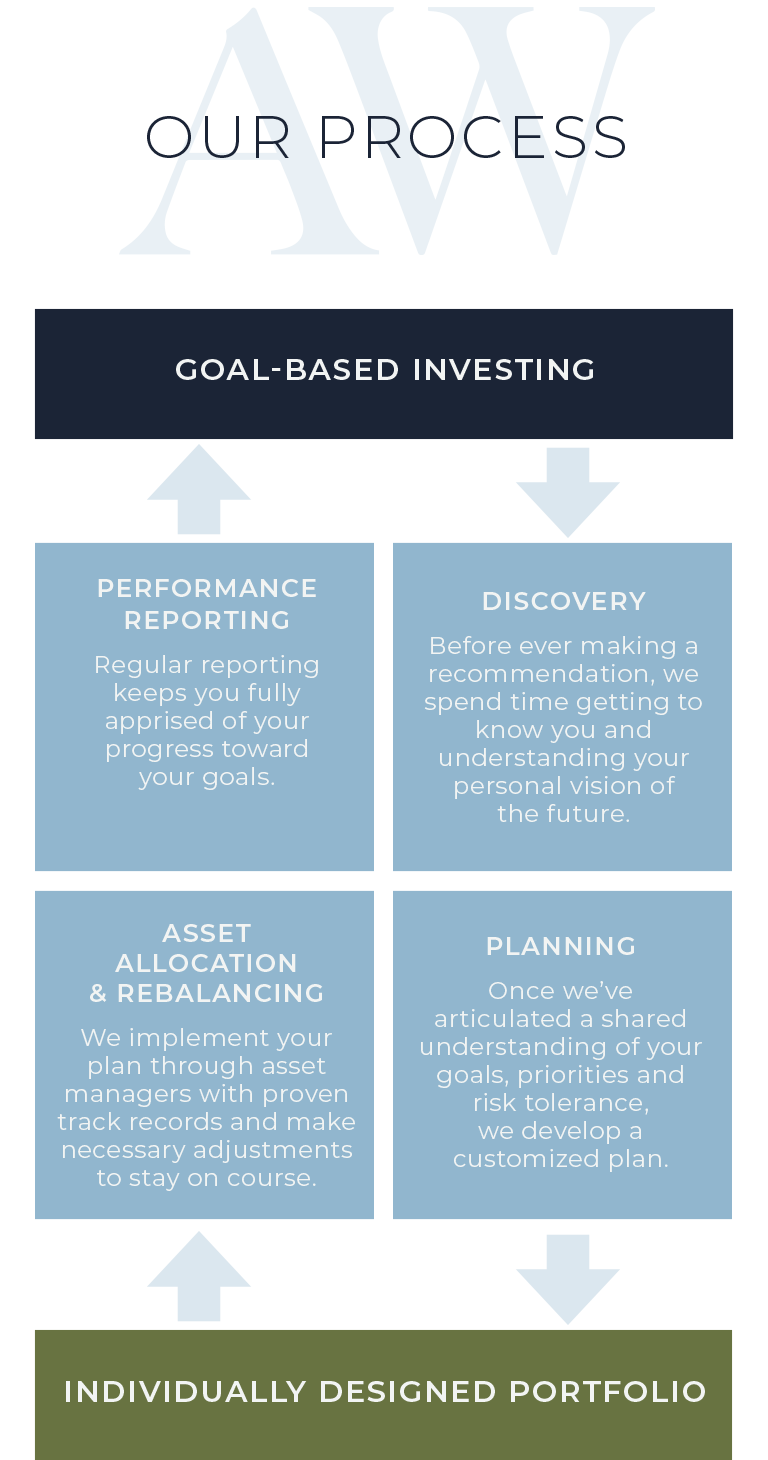

The goalbased investing planning process comprises 5 phases #1 Define possible financial objectives #2 Identify current and future available resources #3 Determine the appropriate strategy for the distribution of capital between savings and investments, in accordance with their characteristics and personal conditions, and aimed at achieving objectives #4 Implement the plan Goalbased investing is based on a technique used by institutional investors called "assetliability management," which aims to match future assets with future expenditures In other words, goalbased investing seeks to ensure that you have enough money when you Investing in a systematic manner is one way to achieve these goals Giving your investments a target to achieve, on the other hand, helps you appreciate the importance of your investment Goalbased investing is a method of making investments after determining what you want to do in the future

I Am Now Ready To Do Goal Based Investing What Now Arthgyaan

Invest With Goals In Mind

Goalsbased investing is an approach which aims to help people meet their personal and lifestyle goals, whatever they may be, in a straightforward and simple way It does this by placing people's goals right at the centre of the advice process and aims to Goalsbased investing may seem like an obvious concept, but it represents a departure from the typical risktolerance framework, which profiles clients based on whether they have a conservative GoalsBased Investing Should It Be the Norm?

Goal Based Investing Ppt Powerpoint Presentation Outline Outfit Cpb Powerpoint Slide Presentation Sample Slide Ppt Template Presentation

Back To The Future The Return Of Objective Based Investing Capital Group Canada Insights

Goal based investing in India revolves around the concept of investing regularly to meet the desired financial goals in the future With the proper assistance and the right use of this strategy, an investor can achieve all the financial targets in the expected time frameInvesting regularly to be able to reach the respective financial goal is called goalbased investing For example, if you plan to buy a car in next 23 yeas, it can be called a shortterm goal Likewise, if you wish to plan for your retirement and children's higher education, then these can beGoalbased investing is an approach that aims to help you come up with a plan to save and invest some of your current earnings smartly to accomplish a specific financial goal in future We all have financial goals but sometimes we do not know how much it will cost, how much to save today, or where to invest the savings in order to achieve future goals

Investment Accelerator Goal Based Investing Software Planning

Goal Based Investing Through Mutual Funds Mymoneysage Blog

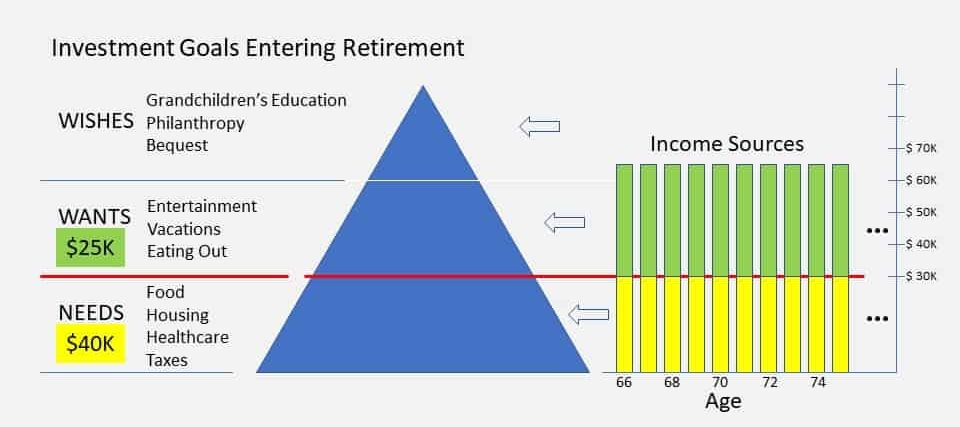

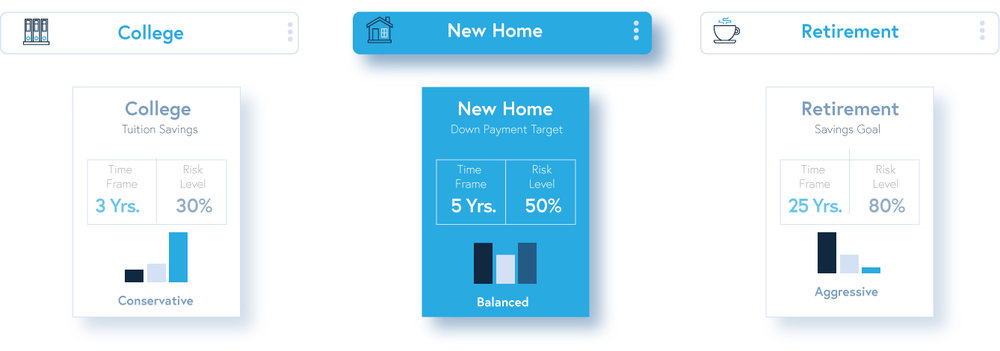

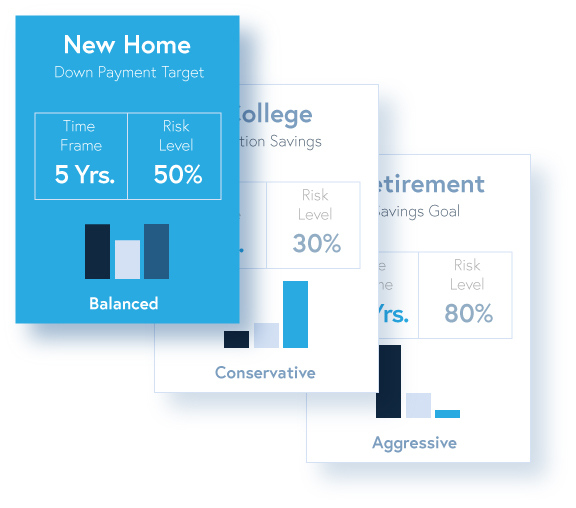

Goalsbased investing differs from traditional asset allocation by linking separate investment portfolios to specific goals Investors are willing to take different levels of risk with different goals, and by creating a separate portfolio for each goal, each with a different risk profile and time horizon, it's possible to tailor the allocation toward achieving a specific goal Goalbased investing is an investment approach that considers one's end financial goal, hence helping the investor make investments that complement the end goal By linking the investments to a goal, the aim of this approach is to systemize savings over a specific duration to yield expected results Goalsbased investment theory not only acknowledges these goals, it provides budgets and portfolios for them In the end, goalsbased investing is simply about using financial markets to achieve your goals under realworld constraints But that can only happen by first understanding and modeling the objectives you're actually trying to achieve

Why Practicing Goal Based Investing Is Essential For Small Investors

Diy Stock Investing Vs Goal Based Investing Tbng Capital

MintWalk Best Mutual Funds App Goal Based Investment We understand that finance can be intimidating That's why we've created investment solutions that are personalized for your needs Invest for House, Car, Retirement etc Personalised Investment Plans 50% more successful vs traditional Investing Invest now Save up to ₹46,350 per annum

Goal Based Investing Plan Ahead Simplifying Your Financial Life

Goal Based Reporting Tools For Investment Advisory Firms

What Is Goals Based Investing And How Does It Work Manulife Private Wealth

The Power Of Goal Based Investing First Republic Bank

Are You Investing Towards Your Goals Boston Private

Three Pillars Of Goal Based Investing First Rate

Goal Based Investing A Structured Approach

Goal Based Investing A Structured Approach

Investing To Achieve Your Goals News Acorn Financial Services Adelaide Advice Super Insurance

Goals Based Investing For Affluent Families And Individuals Sei

1

Goal Based Investing The Planning Process In Practice Investorpolis

Goals Based Investing Private Wealth Partners

Goal Based Investing Alpha Wealth Advisors Llc

Goals Based Investing An Approach That Puts Investors First

Goal Based Investment Planning Retirement Planning Example And Video

Horizon Investments Goals Based Investing

Flat Fee Investment Portfolios Derive Wealth

Goal Based Investments Financial Planning Guide Advisors

Use Private Equity Real Estate To Meet Personal Investment Goals

Amazon Com Goal Based Investing Theory And Practice Romain Deguest Lionel Martellini Vincent Milhau Books

What Is Goal Based Investing Why It Is Important For You Kuberverse

Goals Based Investing Suggested As Replacement To Advisers Traditional Approach Ardent Wealth

What Is Goal Based Financial Planning Anyway Stable Investor

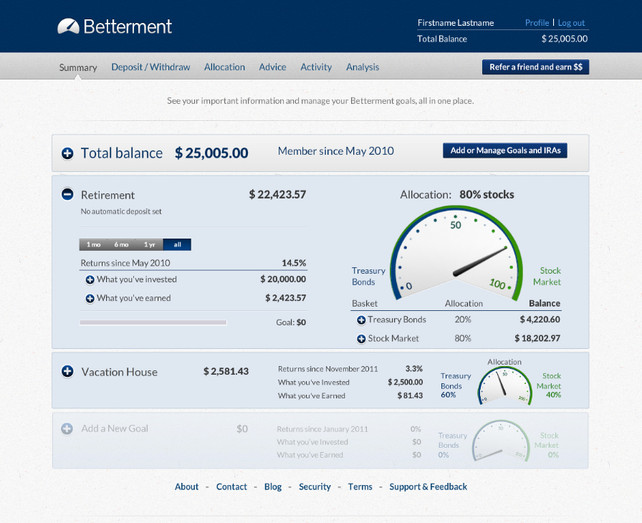

Betterment Review Get Motivated With Betterment S Goal Based Investing The Humble Broker

Understanding How To Apply Goal Based Investing Practically Motilal Oswal

Learn More About Goal Based Investing Today Iinvest Solutions

Goals Based Investing An Approach That Puts Investors First

Fintech Innovation From Robo Advisors To Goal Based Investing And Gamification Wiley

Goals Based Investing Should It Be The Norm Cfa Institute Enterprising Investor

Goal Based Investment Gold Property Investment Advice Bmfpa

Goals Based Investing Horizon Investments

What Is Goal Based Investing Forbes Advisor India

I Am Now Ready To Do Goal Based Investing What Now Arthgyaan

_1616062655053_1616062665121.jpg)

The Importance Of Goal Based Investing For Wealth Creation Hindustan Times

The Power Of Goal Based Investing First Republic Bank

Rankmf Baskets The Best Approach To Goal Based Investing

Using Investment Goals At Betterment Goal Based Investing Advice

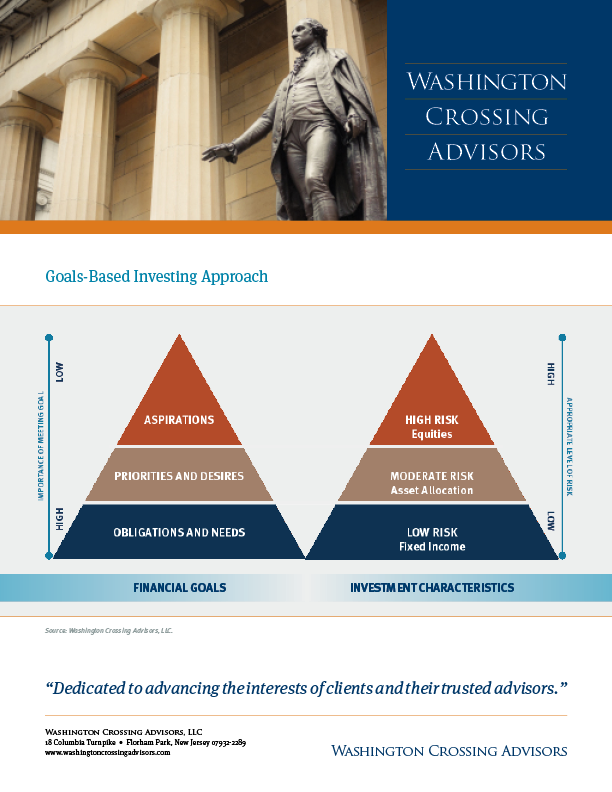

Principle 8 Match Your Strategy To Your Goals Washington Crossing Advisors

You Can Be Rich Too With Goal Based Investing P V Subramanyam And M Pattabiraman Amazon Com Books

Financial Success Using Goal Based Investment Key To Success

Money Vs Me Goal Based Investing Process Of Goal Based Facebook

What Is Goal Based Investing Baraka

Where There S A Goal There S A Way Goal Based Investing

Goals Based Investing The Cnr Way A Fresh Take On An Established Approach

I Have Heard Of Goal Based Investing What Now Arthgyaan

Why Practicing Goal Based Investing Is Essential For Small Investors

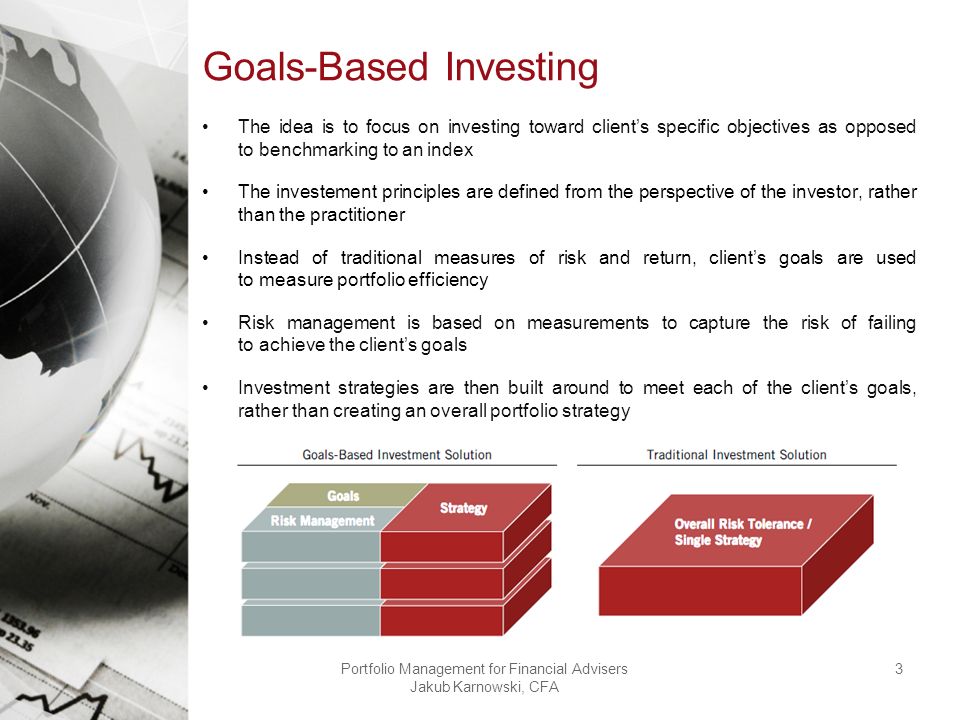

Goals Based Investing Integrating Traditional And Behavioral Finance Jakub Karnowski Cfa Portfolio Management For Financial Advisers Ppt Download

Plan Your Financial Life With Purpose The Importance Of Goal Based Investing

Goal Based Investing Plan Your Financial Life With A Purpose Youtube

Goal Based Investment Planning

Goal Based Investing Platform Fountain Raises First Seed Round Startacus

Goal Based Investing Alpha Wealth Advisors Llc

Why Practicing Goal Based Investing Is Essential For Small Investors

:max_bytes(150000):strip_icc()/ellevest-vs-betterment-ebf2bcde1eec4958969a2d2171f2687c.png)

Goal Based Investing Definition

Goal Based Investing Savings Buckets Betterment

Goal Based Investing Planning For Key Life Events 19 Financial Poise

My Goals

Practicing Goal Based Funding Is A Should India Dictionary

Goal Based Investing Gbi Edhec Risk Institute

Goal Based Investing Process Investment Benefits Wiseradvisor Infographic

Goal Based Investing How To Fund Your Goals U Optomatica

Learn More About Goal Based Investing Today Iinvest Solutions

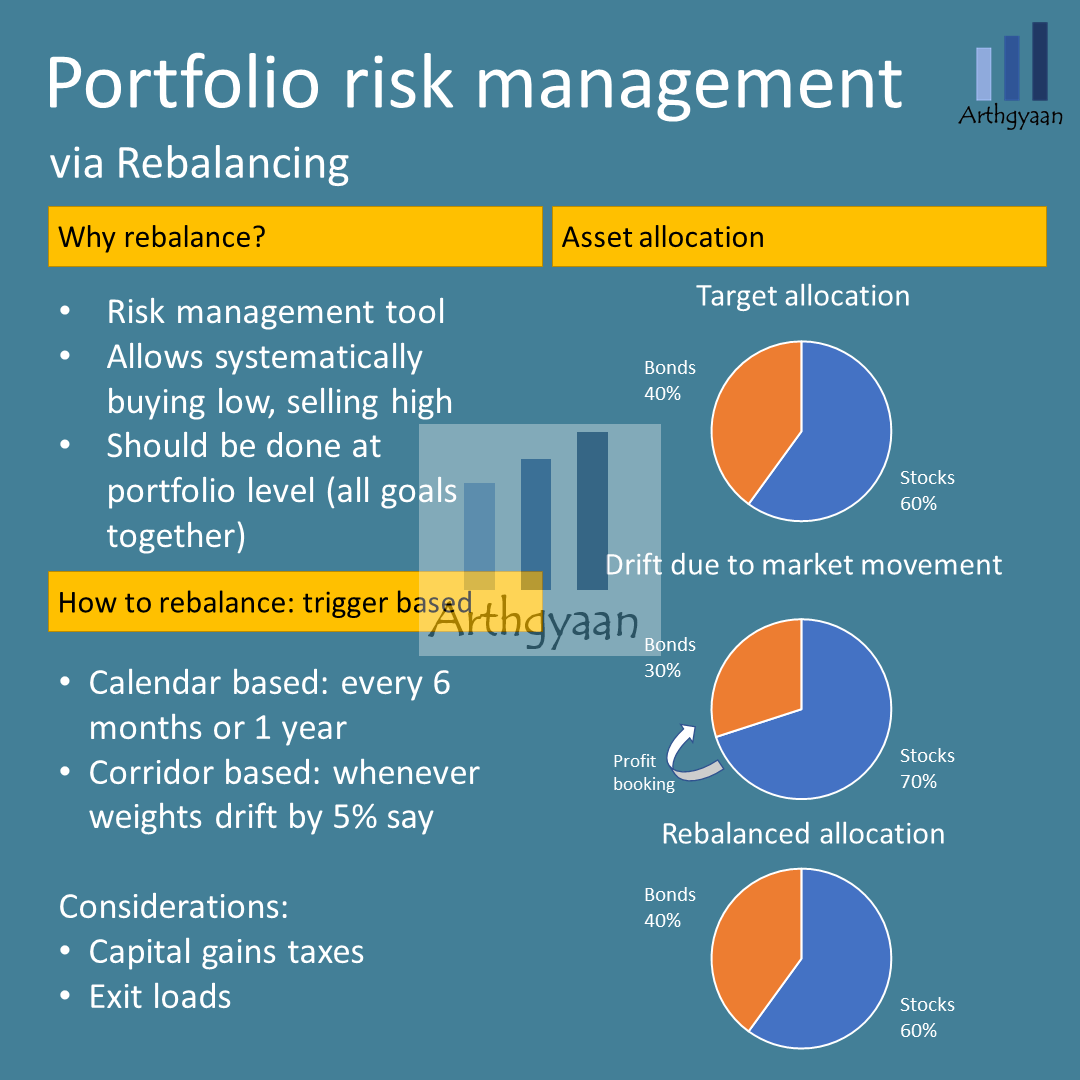

Portfolio Rebalancing During Goal Based Investing Why When And How Arthgyaan

Goal Based Investing Quantifeed

Real Success With Goals Based Investing Proactive Advisor Magazine

What Is Goal Based Investing Baraka

Eton Advisors Wealth Management

Goal Based Investing Through Mutual Funds Mymoneysage Blog

Goal Based Investing And Application To The Retirement Problem Edhec Risk Institute

Eton Advisors Wealth Management

Goal Based Investing Blog Central Investment Advisors

What Is Goal Based Financial Planning Peak Financial Services

Why Practicing Goal Based Investing Is Essential For Small Investors

Richvik Wealth Advisory Private Limited However Giving The Investments A Goal To Achieve Makes You Better Understand The Value Of Your Investment Goal Based Investing Is A Process That Makes Your Investments

Learn More About Goal Based Investing Today Iinvest Solutions

Goals Based Investing And Why It Matters Endowus Sg

Money Musingz Personal Finance Blog Goal Based Financial Investing

:max_bytes(150000):strip_icc()/Bettermentvs.Wealthfront-5c61bcf246e0fb0001dcd5c2.png)

Goal Based Investing Definition

Smart Investing Asset Allocation In The Time Of Coronavirus Crisis The Financial Express

A Framework For Goals Based Investing Boston Private

Goal Based Investing Through Mutual Funds Youtube

0 件のコメント:

コメントを投稿